In August of 2022, the United States passed the Inflation Reduction Act (IRA). Over the next ten years, the IRA will provide almost 400 billion USD in investment toward energy reform and climate change, with over half of this allowance allocated to tax incentives or subsidies on green products (Badlam et al., 2022). In doing so, one potential result is that the prices of green products and products made with fossil fuels will eventually become competitive, if not equal. Once the price difference is negligible, the hope is that consumers will opt for vehicles, appliances, and other products that operate on renewable energy, reducing the country’s carbon footprint. However, the IRA’s effects extend beyond U.S. borders. By subsidizing the green economy, European startups are being lured to a lucrative market across the pond.

The principle that a product produced with clean energy costs more than a similar product produced with fossil fuels is known as the Green Premium. Taking automobiles, for example, the average price of purchasing a new car in the U.S. was around $46,000 in 2021. The average price of a new electric vehicle (EV) was $56,000, making the Green Premium on EVs $10,000 (Winters, 2021). So how is the U.S. effectively lowering the cost of green products by thousands of dollars, and why can Europe not do the same?

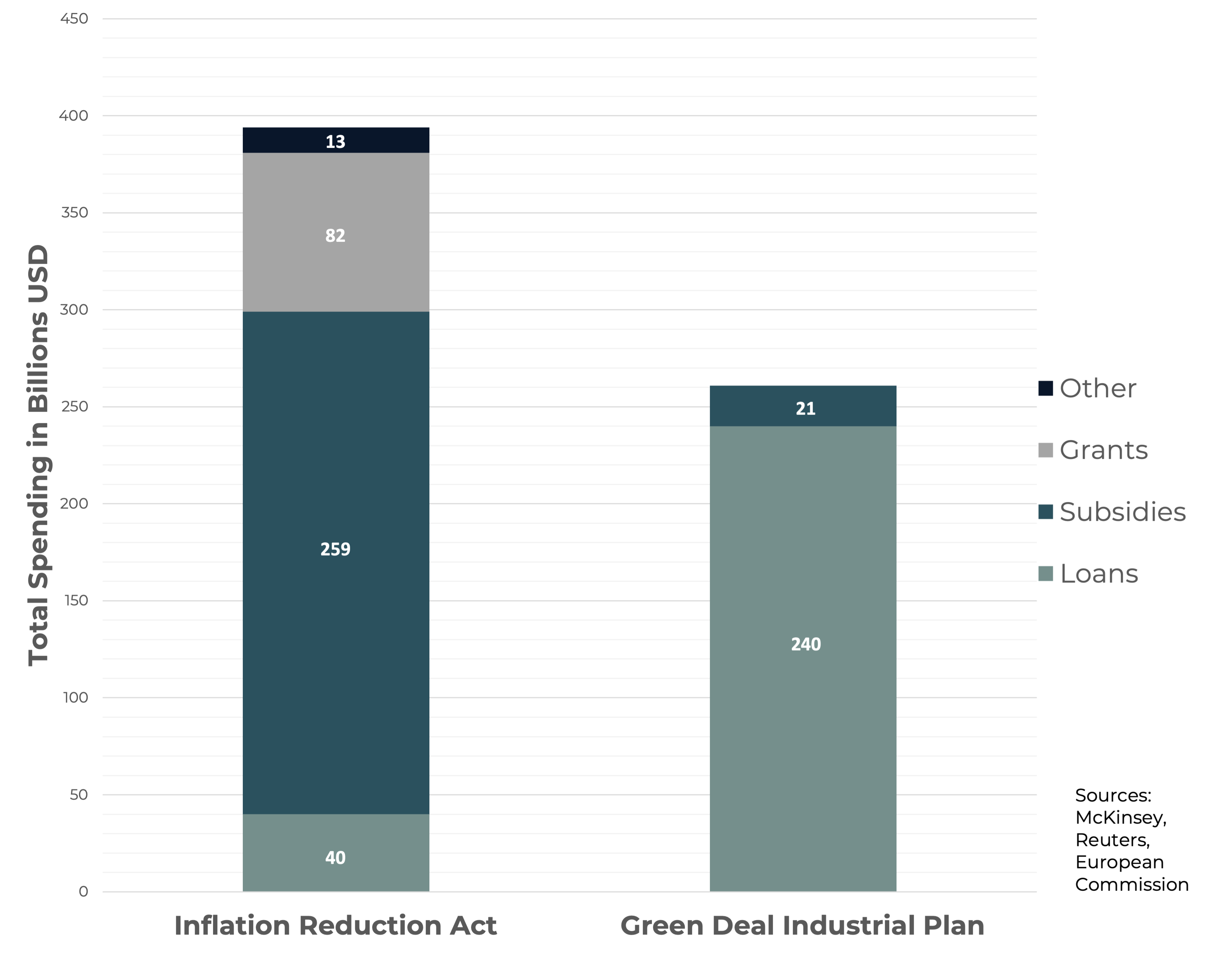

The funds in the IRA, as they pertain to energy and climate change, are delivered in three avenues: subsidies (including tax incentives), grants, and loans. Of the $394 billion, $259B are consumer and corporate subsidies that do not need to be paid back (Figure 1). The government is going to bite the Green Premium-sized bullet to make green products competitive in the marketplace. In this category, $43B are available to consumers as tax incentives. The value of these tax incentives varies for an assortment of products, such as $7,500 and $4,000 rebates for new and used vehicles, respectively, and 30% or up to $1,200 off for appliances, solar panels, geothermal heating, and home batteries. By far, the biggest beneficiaries of the subsidies are corporations, saving a total of $216B. This pot is filled with everything from switching to solar power to buying energy-efficient utilities to buying commercial EVs (Badlam et al., 2022).

Naturally, these incentives sound good to both consumers and producers of green products. However, the U.S. is only permitting North American producers to reap the benefits of their program. Again using automobiles as an example, 50% of an EV’s battery must be produced in North America if the vehicle is to qualify for the tax deductions—and this number only rises throughout the duration of the IRA. By 2029, the last full year of the program, the entire battery will have to be produced on the continent (Smith, 2022). This production stipulation forces businesses to move overseas or risk forgoing massive sales incentives. The European Union, unfortunately, has few cards left to play if they are to prevent corporate exodus.

The European Response, spearheaded by EU Commission president Ursula von der Leyen, is titled The Green Deal Industrial Plan. Von der Leyen’s plan boasts the goals of reducing regulations, providing easier and greater access to funding, enhancing necessary skills, and opening trade. However, the legislation falls short regarding the second goal. The current funding strategy for the Green Deal is to tap into existing funds, including REPowerEU, InvestEU, and the Innovation Fund (“The Green Deal Industrial Plan”, 2023). In total, around $261B will be available. The breakdown of these funds, however, is less favorable than startups were hoping for. The vast majority (90+ per cent) of funding will be issued through loans, whereas just $21B are available in subsidies—at the EU level—that is (Figure 1) (Blenkinsop & Abnett, 2023).

Figure 1. Composition of the IRA’s and Green Deal Industrial Plan’s Funds

Many commissioners are worried that if there is no subsidy package (or an EU Sovereignty Fund, as the Commission is calling it) and state aid rules are relaxed, wealthier nations, namely France and Germany, will issue their own subsidies and leave other EU nations to fend for themselves (Rapoza, 2023). Even less desirable, French and German subsidies may draw businesses out of lesser-developed economies, further exacerbating economic disparities within the EU.

Unfortunately for the startup ecosystem, a hypothetical Sovereignty Fund is far away. Experts predict that it could take the Commission between six months and as long as 3 years to pass and implement a subsidy bill (“Von der Leyen will US-Subventionen kontern”, 2023). With 20% of EU startups failing within one year of their founding, this is a timeframe many cannot withstand (“One-year business survival rates”, 2023). Further complicating matters, the Sovereignty Fund is already facing opposition from 10 of the 27 Commissioners (Strupczewski, 2023).

Whether or not a Sovereignty Fund is passed, the interim Green Deal funds will likely not suffice. Even if all $21B are used to hold the EU states over for a year or two until a Sovereignty Fund could be implemented, the funding would still fall significantly short of the IRA subsidies, which can shell out a whopping $34B per year. In the time any form of pan-EU fund tantamount to the IRA could be mobilized, the competition only becomes more fierce for European startups.

The IRA, which is already in action, is fueling sales, R&D, and tax cuts for businesses. Furthermore, American startups are becoming increasingly investible. According to Pieter Houlleberghs, managing director of decarbonization investing at BlackRock, “The incentives in the law could drive a virtuous cycle across newer technologies and markets: It will encourage more adoption, which drives down costs, which drives up adoption, which then further drives down costs — which is what we as investors look for. The multiplier effect of the incentives in the bill means that the market for attractive green investments effectively just got bigger” (2023).

European startups already struggle to gain access to funding, and widening this gap will make startup viability on the continent increasingly constrained. When comparing venture capital investments in Europe and the U.S. as a percentage of GDP, the U.S. already invests a volume 2.4 times greater (IE.F, 2023). According to the IEF’s own 2023 venture capital study, “Für 43,8% der deutschen Start-ups stellten 2022 – nach Daten des Deutschen Startup Monitors 2022 – Finanzierungsengpässe das größte Geschäftshindernis dar.” Ahead of labor shortages, inflation, low demand, the crisis in Ukraine, and the corona pandemic, funding remained the most prominent headwind to startups.

Beyond subsidies, grants, and loans, laying out a predictable future is perhaps the most valuable aspect of the IRA to startups looking for a capital investment. Tax deductions for purchasing an EV are not new to the U.S. Since 2008, qualifying EVs have been eligible for the same $7,500 credit. However, this incentive was only offered on a per-annum basis, and investors were unaware whether or not the offering would be renewed (“Credits for New Electric Vehicles”, 2023). With the IRA, however, there is a 10-year guarantee. According to the founder of SOSV, a climate tech venture capital firm, “Ten years is long enough to change the landscape. The job of a VC is to take the stuff that’s in a biology lab or chemistry or physics lab, and make it so affordable that in five or ten years’ time, everybody has changed their way of interacting with the environment” (2023). Because the IRA is working to erase the Green Premium, making green products widely affordable, venture capital firms can take a more confident and calculated risk when buying into climate tech startups, proliferating both the volume and magnitude of investments.

No matter their spending package goals, one systematic hindrance in the European venture capital space remains: a lack of institutional investors. As von der Leyen and her colleagues cited in their article in the Tagesspiegel on Friday, “In der EU erfolgt die externe Unternehmensfinanzierung zu 75 Prozent über Bankdarlehen und zu 25 Prozent über die Anleihemärkte – in den USA ist genau das Gegenteil der Fall” (2023). The five authors go on to describe how their goal of establishing a strong single capital market begins with revitalizing the Capital Markets Union (CMU). Within the CMU, von der Leyen points out that Europeans have a great deal of money in savings, more than Americans even, suggesting that the solution to a more competitive European marketplace is greater than a state aid package. Mobilizing institutional investors to bet on small and medium-sized enterprises is the real champion for capital investments.

In Europe, where access to venture capital for startups is already trailing the U.S., the impact of the IRA may disrupt the EU’s plans to be world leaders in the climate revolution. Without a rapid solution to prevent startups from flowing out of Europe and into the U.S., the European Commission jeopardizes invaluable domestic innovation.